What is Home Equity?

Home equity is simply the part of your home that you actually own. It’s the difference between what your home is worth and what you still owe on your mortgage. As you pay down your mortgage and your home’s value goes up, your equity increases.

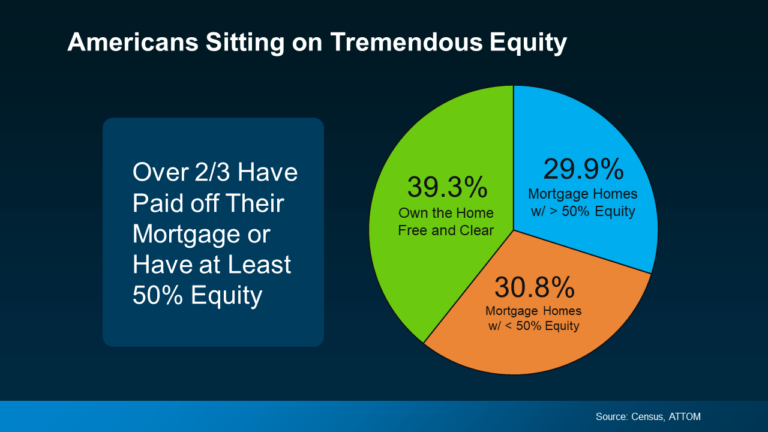

Recent data from the Census and ATTOM reveals that many Americans are in a strong equity position. Right now, more than two-thirds of homeowners have either fully paid off their mortgages (as highlighted in green in the chart below) or have at least 50% equity in their homes (as shown in blue in the chart below).

How to Calculate Home Equity

Calculating your home equity is pretty straightforward:

Market Value (Current Home Value) – Mortgage Balance (What You Owe) = Home Equity (What You Own)

For example, if your home is valued at $400,000 and you owe $250,000 on your mortgage, your equity is $150,000.

Why Home Equity Matters

Home equity is a powerful financial asset. It’s like a savings account that can grow over time, helping you fund home improvements, consolidate debt, or act as a safety net in tough times. The more equity you have, the more financial options you can explore.

How to Build Home Equity

You can build home equity in two main ways:

- Paying Off Your Mortgage: Each mortgage payment reduces your loan balance, which increases your equity.

- Property Value Increases: As your home’s market value goes up, so does your equity.

Both of these methods require time, but they play a crucial role in building your financial future.

The Perks of High Home Equity

1. Borrowing Power

When you have more equity, you can borrow more through a home equity loan or line of credit (HELOC). This money can be used for home improvements, paying off debts, or even investing in other opportunities.

2. Lower Interest Rates

Loans that are backed by your home equity often come with lower interest rates than other types of loans. This can save you money if you need to borrow for large expenses.

3. Financial Security

Having high equity gives you a safety net. If you need to sell your home during a downturn in the market, having more equity can help ensure you don’t end up owing more than your home is worth.

Smart Ways to Use Your Home Equity

Using your home equity wisely is key. Here are some ideas:

1. Home Improvements

Investing in your home can boost its value and increase your equity. Focus on projects that offer a good return on investment, like upgrading your kitchen or adding energy-efficient features.

2. Paying Off Debt

You can use home equity to consolidate high-interest debts. This can save you money over time, but be careful not to accumulate more debt afterward.

3. Emergency Fund

Your home equity can be a backup in emergencies. However, it’s also important to keep some savings that you can access quickly without having to borrow against your home.

Be Aware of the Risks

While home equity loans and HELOCs can be helpful, they come with risks. Borrowing against your home increases your debt, and if you can’t make the payments, you could face foreclosure. It’s important to borrow only what you can afford to pay back.

Keeping Track of Your Home Equity

Regularly checking your home equity is important for making smart financial decisions. Use online tools or talk to a real estate professional to stay informed about your home’s value. This will help you decide when to refinance, sell, or use your equity for other purposes.

Tips for Boosting Your Home Equity

1. Stay Informed on Market Trends

The real estate market changes over time. Understanding what’s happening in your local market can help you make better decisions about buying, selling, or refinancing your home. A trusted real estate agent can be a valuable resource.

2. Consider Refinancing

Refinancing your mortgage when interest rates are low can help you pay off your loan faster, which increases your equity.

3. Make Smart Home Improvements

Not all home improvements are equal. Choose upgrades that not only make your home more enjoyable to live in but also increase its value. This way, your investment will pay off by boosting your equity.

Conclusion

Understanding and managing your home equity is key to building wealth and securing your financial future. By making informed choices, you can use your equity to improve your home, reduce debt, and prepare for the future. Keep an eye on your equity, make smart improvements, and work with professionals to maximize your home’s value.