This might lead you to believe that home prices are on the decline. However, it’s important to distinguish between asking prices and sold prices.

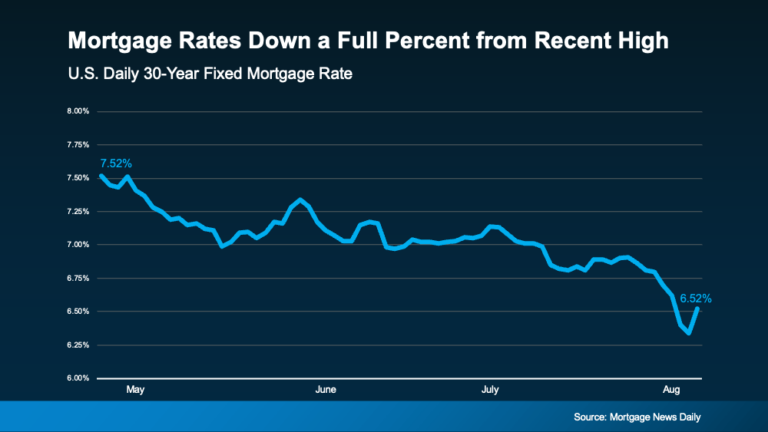

Mortgage rates have recently dropped by a full percentage point, creating a great opportunity for those looking to buy a home or refinance their current mortgage. Understanding what this means for you can help you make the best decision in today’s market.

What the Mortgage Rate Drop Means for You

The recent drop in mortgage rates is significant. It’s more than just a small change—it’s a big shift that can greatly impact your ability to afford a home. With rates dropping from their recent highs, now could be the perfect time to consider buying a home or refinancing your existing mortgage.

How Mortgage Rates Affect Your Buying Power

The interest rate on your mortgage directly affects how much you pay each month and how much your loan will cost over time. A decrease of just one percent can lead to substantial savings.

Example: Monthly Payment Savings

Let’s say you’re looking at a 30-year fixed mortgage on a $400,000 home with a 20% down payment:

At 7% Interest Rate:

- Monthly Payment: $2,129

- Total Interest Paid: $366,039

At 6% Interest Rate:

- Monthly Payment: $1,919

- Total Interest Paid: $317,936

This one percent drop saves you $210 per month and over $48,000 in interest over the life of your loan.

How Lower Rates Make Homes More Affordable

When mortgage rates go down, you can either afford a more expensive home or enjoy lower monthly payments on a home within your current budget.

Affordability Comparison

Here’s a simple way to see how much more home you can afford with lower rates:

| Interest Rate | Home Price | Monthly Payment |

|---|---|---|

| 7% | $350,000 | $2,329 |

| 6% | $380,000 | $2,275 |

With the rate drop, you could afford a $30,000 higher-priced home while keeping your payments about the same.

Refinancing: A Chance to Save More Money

If you already own a home, this drop in mortgage rates might be the perfect chance to refinance your loan. Refinancing can help you lower your monthly payments, shorten the term of your loan, or even get some cash out of your home’s equity.

Benefits of Refinancing:

- Lower Monthly Payments: By refinancing at a lower rate, you can reduce your monthly payment and free up money for other expenses.

- Pay Off Your Loan Sooner: You might choose to refinance to a shorter-term mortgage, like a 15-year loan, which can help you pay off your home faster and save on interest.

- Get Cash Out: If you have equity in your home, a cash-out refinance could provide funds for home improvements, paying off debt, or other needs.

What Affects Mortgage Rates?

Mortgage rates are influenced by several factors, including the economy, inflation, and decisions made by the Federal Reserve. Knowing these factors can help you predict future rate changes and plan accordingly.

Key Factors:

- Inflation: High inflation can lead to higher mortgage rates, while low inflation can keep rates down.

- Employment Numbers: Strong job growth can push rates higher, while weaker job growth can lead to lower rates.

- Federal Reserve Decisions: The Federal Reserve’s actions on interest rates and policies can directly impact mortgage rates.

"The hopes for lower interest rates need the reality check that 'lower' doesn't mean we're going back to 3% mortgage rates. . . the best we may be able to hope for over the next year is 5.5 to 6%."

Greg McBride, Chief Financial Analyst at Bankrate

How to Take Advantage of the Current Market

With mortgage rates down, this is an excellent time to explore buying a new home or refinancing your current mortgage. Here’s what you can do to make the most of this situation:

For Homebuyers:

- Get Pre-Approved: Before you start shopping for a home, get pre-approved for a mortgage to know how much you can afford and show sellers you’re a serious buyer.

- Lock in Your Rate: With rates changing, it’s smart to lock in your rate as soon as you find the right loan, so you’re protected if rates go back up.

For Homeowners:

- Review Your Current Mortgage: Look at your current mortgage rate and terms to see if refinancing could save you money.

- Consult a Professional: A financial advisor can help you decide if refinancing or another financial move is right for you.

Conclusion

The recent drop in mortgage rates by a full percentage point offers significant benefits for both homebuyers and homeowners. Whether you’re thinking about buying a new home or refinancing your current mortgage, now is the time to act.

For personalized advice on how to navigate the current mortgage market, reach out to us today.

Don’t miss out on this opportunity—take steps today to secure your financial future.